The maximum annual limit is half of the average wage. You can now reward up to CZK 21,983

The maximum annual amount for the use of exempt non-cash benefits for employees remains regulated by the Income Tax Act, Section 6(9)(d). The average wage for the purposes of the 2024 limitation is CZK 43 967.

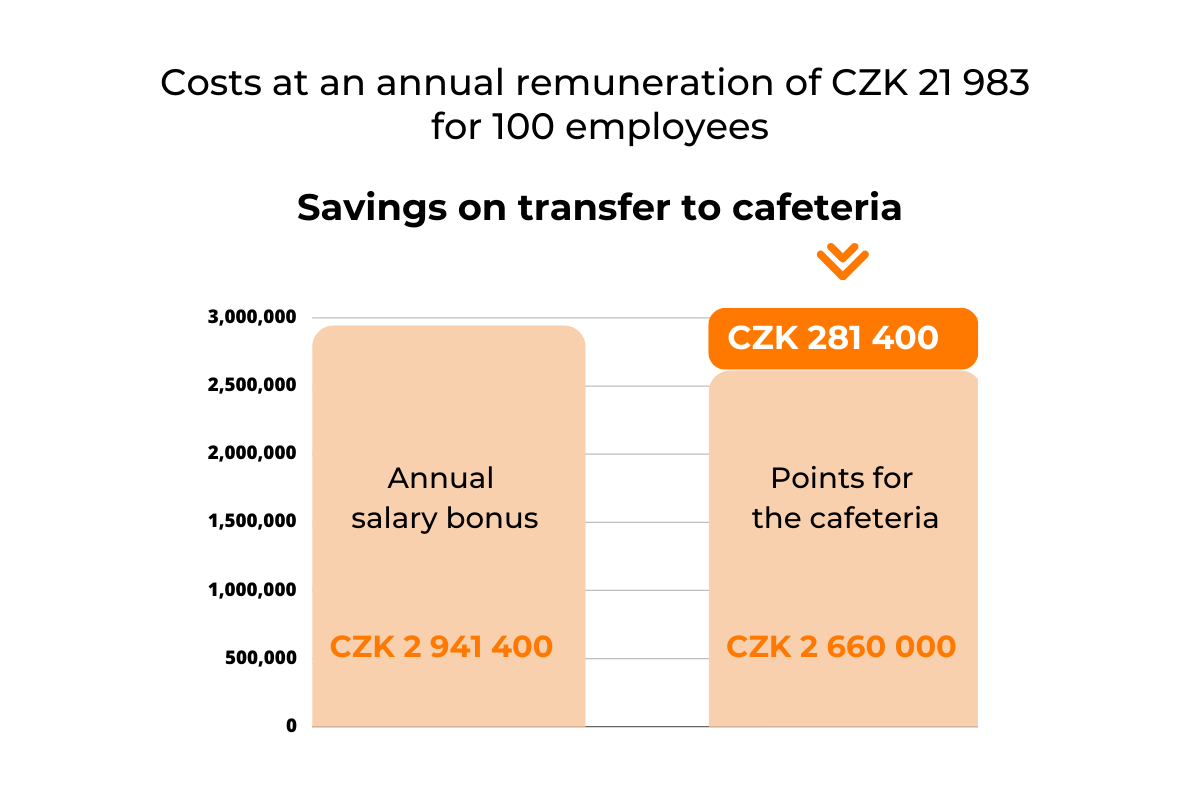

Therefore, from 1 January 2024, the employer may contribute a maximum of CZK 21,983 per year to each employee for exempt non-cash benefits. In connection with the development of the average wage, the amount of the exempt limit for the employee's non-cash benefits will automatically change. The possibility of drawing it should be regulated in an internal regulation, employment contract or collective agreement as non-cash benefits, not as remuneration for work.

In detail, this means that employers can incentivise their employees with an average of CZK 1,832 per month under favourable conditions, which still brings a significant tax advantage for both parties.

Do you have more employees? Enter the number in our calculator

We will check the legal limit for you

Cafeteria Benefits is set up so that from 2024 onwards, thanks to its control mechanisms, it will safely monitor the limits set and their drawdown. Employers who charge employees in batches or at irregular intervals will not have to worry about having to keep complicated records of benefit points in spreadsheets. Nor does it have to worry about employees overdrawing and having to pay the difference in a complicated manner.

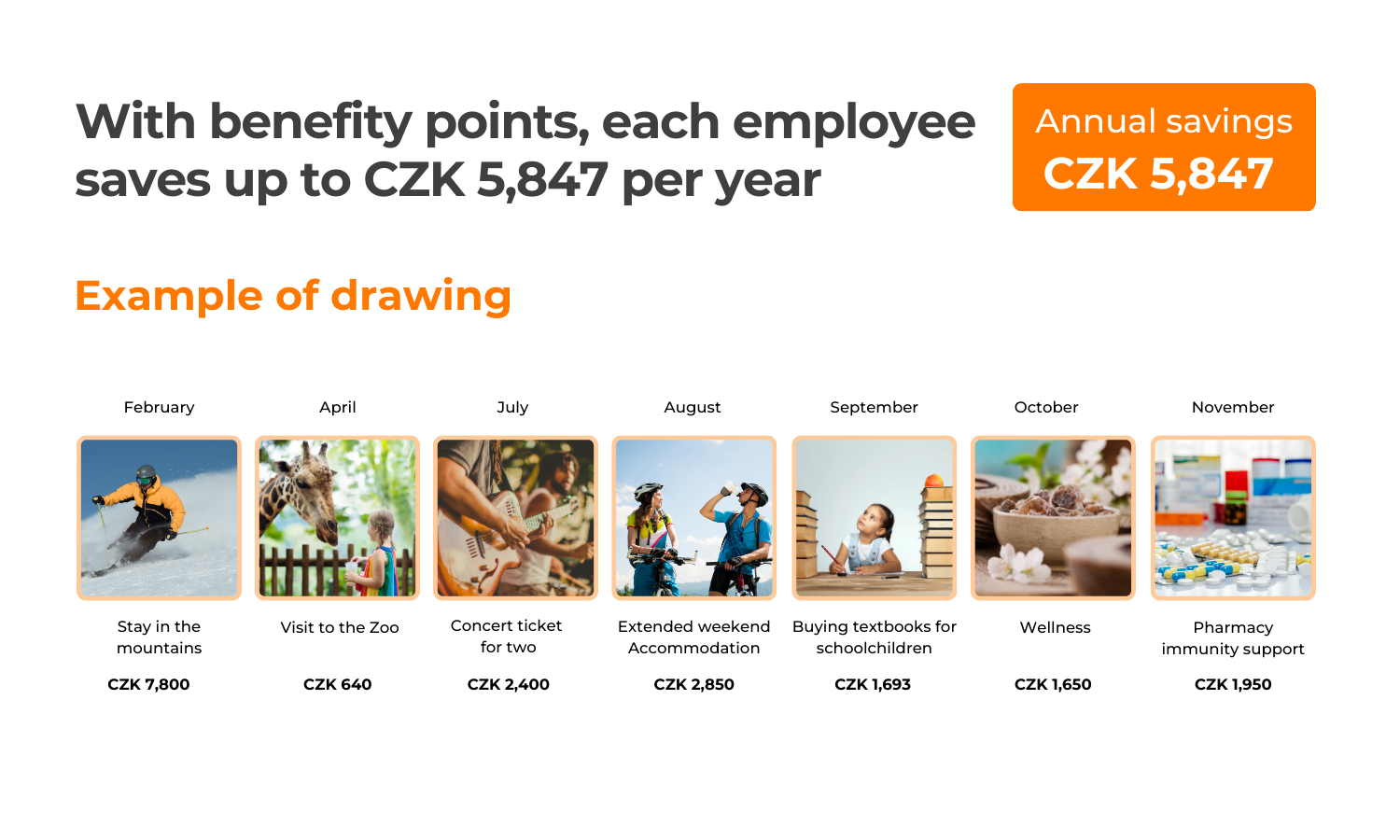

For both parties, the benefits remain a great tax advantage and employees can relax, attend cultural events, shop more cheaply at opticians or pharmacies or take a nice holiday.

The motivational aspect and the meaning of benefits remain unchanged

Therefore, benefits continue to be used as an incentive for employers to save money while allowing their employees to maintain a healthy work-life balance at a more reasonable cost. With the current persistent inflation, this is more than appreciated by all.

With benefits, you'll score with every one of your employers

A constant asset of the benefits is their wide offer in all areas (health, culture, recreation, sports and education) and the possibility of choice for each employee. While some prefer sports, others can use the entire amount for their health, travel or long-term education. However, everyone will appreciate it.

Meal vouchers continue to play an important motivational role

It remains true that meal cards and vouchers play an important motivational role. They do not coincide with the wages paid and are therefore perceived by employees as a benefit that their employer can provide over and above the standard wage.

From January 2024, a new decree has been in force, according to which the maximum domestic meal allowance has risen to CZK 166 per day. It is this amount that is used to calculate the amount of the employee's exempt income (the limit is 70% of the meal allowance = CZK 116.20).

Due to rising inflation and rising lunch prices, employers have the opportunity to increase employee benefits in the form of meal vouchers while always retaining the full amount of the benefit as a tax deductible expense. If you keep the employer's contribution at 55% and the employee's contribution at 45% as in previous years, the value of the meal voucher after rounding is CZK 211*.

If the contribution is above the limit, it will still be a tax deductible expense for the employer. On the employee's side, this amount will already represent taxable income (including social security and health insurance contributions) paid by the employer.

Treat your employees to a proper lunch with a meal voucher worth CZK 211

*Calculation with 55% employer contribution and 45% employee contribution: 116.2/0.55 = CZK 211.27

Are you interested in benefits or a meal voucher for your company?